India has always been a country of paradoxes. As of Jan’21, India had a population of 1.4 BN people, 1.29 BN Aadhaar digital biometric identities, 1.1 BN mobile connections, 761 MN smartphones, 624 MN internet users (45% of country’s population)*.

No doubt, the country has made great strides in:

- Informational Technology development and Outsourcing

- Cloud Computing

- Financial Technology

- Adoption of ICT in sectors like Banking, Railway reservation, Commerce and Industry, etc.,

- Near-universal Mobile phone Penetration

- Universal availability of Unique ID Systems, and

- Evolving Privacy and Data Protection Laws

We would probably consider these as very strong signs of a developed / advanced nation. But, Despite all such developments, India’s:

- Digital Health Ecosystem is in nascent stages

- Health data is mostly not digitized or not standardized, not interoperable, and not readily accessible to Clinicians, Researchers, or Policymakers

- Healthcare sector receives low public spending (~1% of GDP)

Healthcare is considered an integral non-income component in any measure of economic development. India’s Digital Health Mission seeks to challenge and change the entire Healthcare ecosystem.

*Datasource:DigitalIndiaReportbyDatareportal,uidai.gov.in,Statista

Strides to improve quality of healthcare in India

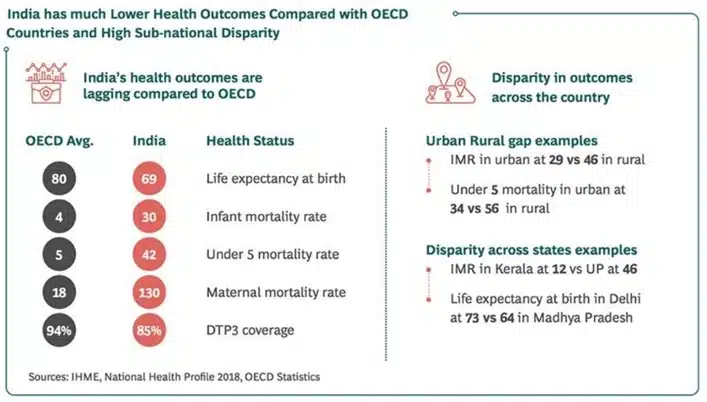

Addressing the poor level of Health Outcomes will be foundational for India’s progress. Efforts to improve the quality of care are particularly challenged by the lack of reliable data on quality and by technical difficulties in measuring quality. Ongoing efforts in the public and private sectors aim to improve the quality of data, develop better measures and understanding of the quality of care, and develop innovative solutions to long-standing challenges.

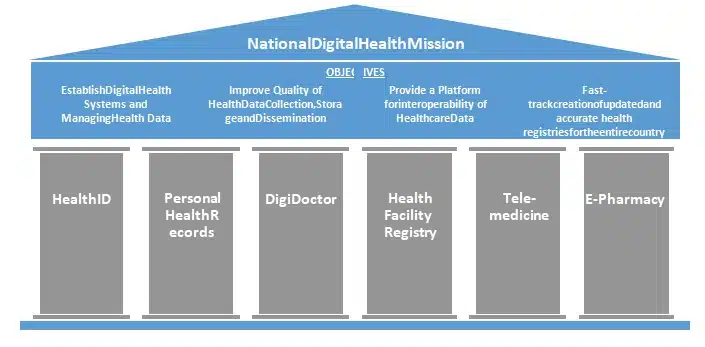

The National Digital Health Mission has set up powerful objectives to accelerate progress towards UN Sustainable Development Goal 3.8 of Universal Health Coverage, uplift the healthcare scenario and improve the quality of care.

The objectives are to:

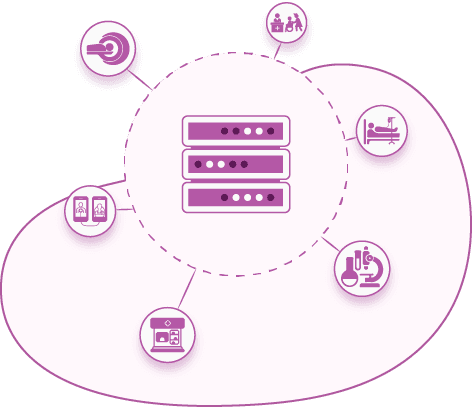

- Establish Digital Health Systems and Managing Health Data

- Improve Quality of Health Data Collection, Storage and Dissemination

- Provide a Platform for interoperability of Healthcare Data

- Fast-track creation of updated and accurate health registries for the entire country

Spanning across Personal Health Records, Tele- medicine and E-Pharmacy- the new healthcare shift is offering promising opportunities.

The new Healthcare paradigm, the vision and its players

The improved health outcomes would bring increased productivity and in turn, an additional benefit of $200- $250B to India’s GDP” over next ten years*.

*Source:BostonConsultingGroup

The Key players in this paradigm shift are Government, Health Professionals and Insurers and an Emerging breed of Health-Tech startups (to play an increasingly central role in driving innovation. The Digital Health Mission is already creating multiple opportunities, both at the macro and micro levels.

- India’s Digital Healthcare market stood at US$ 116.6 BN in 2018 and is expected to increase to US$ 485.4 BN by 2024 (CAGR of 27.4%).

- Digital Health and Technologies are creating capital investments – in 2019, 53% angel investments were made in healthcare. Q1 2020 saw a 50% rise in deal volumes (21 vs. 14 in 2019) and 14% in value (US$ 452 MN vs. US$ 398 MN in Q1 2019).

- Start-ups such as NanoHealth and BeatO are providing / ensuring care for patients suffering from cardiovascular, hypertensive diseases and diabetes.

- Start-ups such as Netmeds, 1MG and Myra are already playing the role of pharmacists, threatening the removal of traditional pharmacists from the healthcare ecosystem

- Karma Healthcare, is providing tele-medicine solutions by connecting patients in the remote parts of the country to physicians in urban areas.

- mHealth (Mobile Health) segment is estimated to dominate the market (with 40% share) by 2024, as a greater number of people are likely to use health & fitness apps to track and monitor daily activities, thereby propelling market growth.

- Medix Global, a London- based innovative digital health management solutions provider is setting up a pan- India digital infrastructure for tele-medicine and offline medical solutions.

- Medix Ventures, a venture capital fund of the Medix Group is also investing US$ 20-30 MN in innovative medical tech start-ups, with focus on India to promote digital med-tech solutions

- Start-up HealthPlix is focusing on making convenient clinical practice by digitizing instructions associated with prescriptions for patients beyond metros and tier-1 cities

- com is providing services to international markets by connecting cancer patients to distant specialists and facilitating sharing of standardized reports between patients and oncologists.

The healthcare scenario in India- A roller-coaster ride.

However, India continues to highlight multiple paradox and challenges within healthcare sector. While there is a simultaneous success and failure, healthcare is clearly on a sustainable edge.

Sources:OECD.org,NationalHealthProfile2019,IBEFblog,BusinessToday.In

India tremendously lags in quality of medical care, with relevant information at point of care also lacking.

- ~2.4 MN Indians die of treatable conditions every year, the worst situation among 136 nations (The Lancet).

- India’s death rate (122 per 100,000) due to poor care quality is worse than that of Brazil (74), Russia (91), China (46) and South Africa (93) and even its neighbors Pakistan (119), Nepal (93), Bangladesh (57) and Sri Lanka (51).

- Apart from poor quality care, insufficient access to care caused a major share of deaths from cancer (89%), mental and neurological conditions (85%), and chronic respiratory conditions (76%).

The opportunity

India has the opportunity to move forward using the HIMSS EMRAM 8-staged Maturity Model as a roadmap which comprises of 7 levels encompassing everything from Ancillaries to EMR.

The challenge

Yet, the Healthcare sector has been grappling with very slow adoption rates of an HMS / EMR.

“Electronic health records were never a technology challenge but an adoption challenge, which only dissolves when clinicians realize the potential of EHR or when there is mandate either from a top management or from the government,” – Prashant Singh, Director and CIO at Max Healthcare.

The Challenges in adoption were primarily on the financial considerations of high costs of procurement and maintenance. Designing of the system without considering fundamental (e.g. number of clicks just to prescribe a sleeping pill) and well- known standards and medical codes such as:

- Health Level Seven (HL7)

- Digital Imaging and Communications in Medicine (DICOM)

- Continuity of Care Record (CCR) & Continuity of Care Document (CCD)

- International Classification of Diseases (ICD) of the World Health Organization

- Systematized Nomenclature of Medicine – Clinical Terms (SNOMED-CT) published by SNOMED International

- Logical Observation Identifiers, Names and Codes (LOINC)

- Inflexibility of the software; IT Support

- Poor electricity supply and internet connectivity

- Limited digital / computer skills of primary user’s

- Lack of regulations for privacy protection.

Research-based Evidences

International Finance Corporation (IFC) panel discussion (Sep’20) called out key aspects of EMR in emerging markets.

- Do not let technology be your master. Manage the technology well to achieve what you want. One size does not fit all – EMRs in the USA will be different from India and South America.

- In emerging markets like Nigeria and others, less than 10% of the hospitals have implemented EMRs. Paper is the biggest competition. Low internet penetration, poor computer literacy and costs are other major impediments for large scale adoption.

- Flexible pricing models for different facility sizes, pay as you go models will be required to be provided by EMR organizations. This would make it more economical for hospitals to adopt these systems.

- Not every facility will require an enterprise level EMR. A modular based system should be offered by EMR organizations. However, do not build systems in silos. This will undermine the potential use of data and efficiencies

- Handholding, educating and training of hospital staff and doctors will be key for successful implementation and adoption of this system on a larger scale Regarding interoperability, the health system is currently not designed to, nor is willing to share patient information. Reporting formats, data collection, integration of platforms and other works will need to be standardized.

- HL7 FHIR (Fast Healthcare Interoperability Resources) based systems will see accelerated growth and drive interoperability. FHIR will be a game changer. Technology will make it possible, but people will make it happen. Hence, it is important to take people along for technology adoption.

Ensuring affordability of EMRs in emerging market will be important. Flexible pricing structure for different facility sizes needs to be designed and offered. Cross subsidization across large systems and smaller facilities is another option. This could also be achieved through local government initiatives and funding.

Think global, act local for EMRs. Use international libraries like ICD 10 and others. Data should be transmittable for research and development. Standards should be global.

Hospitals should be a combination of both digital/paperless and paper based for now. Some services can be completely paperless, but in some, it must be a combination. Hospitals should try to be paperless as much as possible and have a timeline for eventually going fully paperless.

In India’s context, the adoption of EMR has been drastically low. This is due to a) several gaps in the system, b) lack of awareness & computer literacy, c) perceived high cost of implementation, d) lack of technological resources, e) complicated EMR interfaces and f) legacy issues to adopt new systems. The usage of EMR is limited to the big corporate hospitals in the metro cities and some select states and districts in India

These challenges must be tackled head on, especially with initiatives like Ayushman Bharat presenting a valuable opportunity for building a person-centered health system. When this system is fully implemented, Ayushman Bharat will be the world’s largest healthcare program that’s digitally driven.

Leveraging the Healthcare technology opportunity

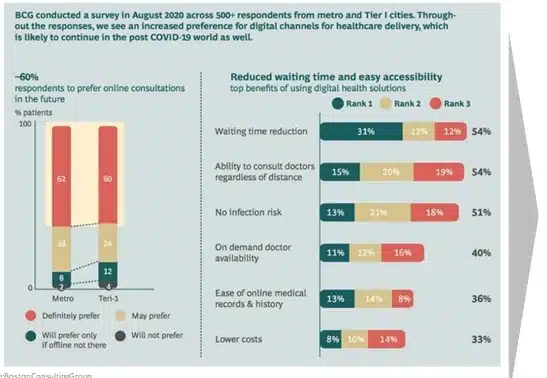

With all said, multiple drivers indicate that Healthcare sectors will be the one to create value and impact.

Source: SMERGERS Industry Watch–Indian Hospital Sector

Health IT providers can help their clients address questions by being a bit more in tune with the innovation that is available to them and adopt that in a nimble, agile manner. You don’t have to deploy everything at once, but if you have a vision and implement in succinct stages, I think that will help the market get to where they need to go.

It’s not about regulatory clicks; it’s about care delivery anywhere and technology addressing the cloud, mobility and Internet of Things that will allow patients to achieve wellness through participating in their own health management – moving them along an awareness to wellness continuum.