Healthcare facilities across the globe face a common yet rarely discussed challenge. Let’s start with the difference between CapEx vs OpEx and the disconnect between what they spend on equipment and what it actually costs to keep that equipment running. While hospitals excel at making substantial capital investments, they often stumble when it comes to planning for the ongoing operational expenses that inevitably follow.

This oversight isn’t just a minor accounting hiccup—it’s a fundamental flaw in healthcare financial planning that can cripple an institution’s long-term sustainability. The excitement of acquiring cutting-edge medical technology often overshadows the less glamorous but equally critical task of budgeting for its lifecycle costs.

CapEx vs OpEx: Understanding the CapEx Trap

The Allure of Big Purchases

Hospitals have an undeniable attraction to significant capital expenditures. Something is compelling about investing in state-of-the-art equipment that promises to revolutionise patient care and enhance the institution’s reputation. Whether it’s a new MRI machine, advanced surgical robots, or smart hospital beds, these purchases often receive enthusiastic approval from boards and administrators.

The psychology behind this preference is understandable. Capital expenditures are tangible, visible investments that demonstrate progress and commitment to quality healthcare. They make for impressive press releases and can boost staff morale by providing them with the latest tools to serve patients effectively.

The Oversight That Costs Millions

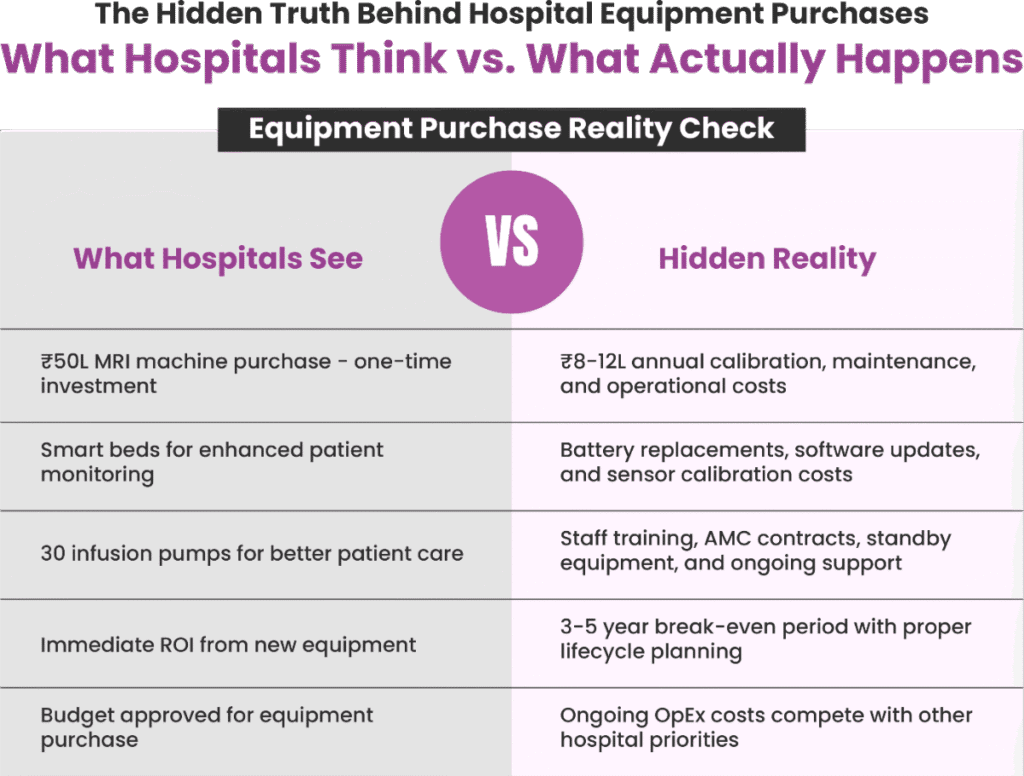

However, this enthusiasm for capital investments often comes with a dangerous blind spot. Consider the hospital that proudly purchases a ₹50 lakh MRI machine, celebrating the acquisition as a major step forward in diagnostic capabilities. The purchase order is signed, the equipment is installed, and the hospital begins using it immediately. But somewhere in the excitement, a crucial question was overlooked: what about the ongoing costs?

Annual calibration requirements, regular maintenance schedules, software updates, and eventual component replacements were never factored into the budget. The result is a shocking discovery months later when the first maintenance bill arrives, revealing costs that weren’t anticipated or planned for.

Must Read- HIMS Software in Healthcare Analytics | Ezovion

CapEx vs OpEx: Common OpEx Oversights in Healthcare

Medical Equipment Maintenance Gaps

The examples of operational expense oversights are numerous and costly. Smart beds, for instance, represent a significant technological advancement in patient care. They can monitor vital signs, adjust positioning automatically, and integrate with hospital information systems. However, these sophisticated devices rely on batteries that require regular replacement, software that needs updating, and sensors that must be calibrated periodically.

When hospitals fail to budget for these recurring costs, they often find themselves in the uncomfortable position of having expensive equipment that cannot function optimally due to deferred maintenance or delayed component replacements.

Training and Support Costs

Another frequently overlooked aspect is the human element. Purchasing 30 infusion pumps might seem straightforward, but each device requires staff training, ongoing education as software updates are released, and a comprehensive maintenance plan. Additionally, hospitals need standby equipment and service contracts to ensure continuous operation.

The true cost of equipment extends far beyond the initial purchase price. It encompasses training programs, service contracts, backup systems, and the administrative overhead required to manage these assets effectively.

Must Read- Predictive Analytics in Combating Hospital-Acquired Infections – Ezovion

CapEx vs OpEx and The Hidden Burden of Capital Assets

When Assets Become Liabilities

Every capital asset transforms into an operational burden when hospitals fail to plan for its complete lifecycle. This transformation occurs gradually, often going unnoticed until maintenance costs begin to impact other areas of the hospital’s budget. Equipment that was once viewed as a valuable investment suddenly becomes a financial drain on resources.

The most successful healthcare institutions recognise this reality from the outset. They understand that purchasing medical equipment is not a one-time transaction but rather a long-term commitment that requires ongoing financial planning and resource allocation.

The Ripple Effect

When operational expenses are not properly planned, the effects ripple throughout the organization. Departments may find themselves competing for limited maintenance budgets, leading to deferred upkeep and reduced equipment lifespan. Patient care can suffer when equipment is not properly maintained, and staff productivity decreases when they cannot rely on their tools to function consistently.

Smart Financial Planning for Healthcare Leaders

Calculate Total Cost of Ownership

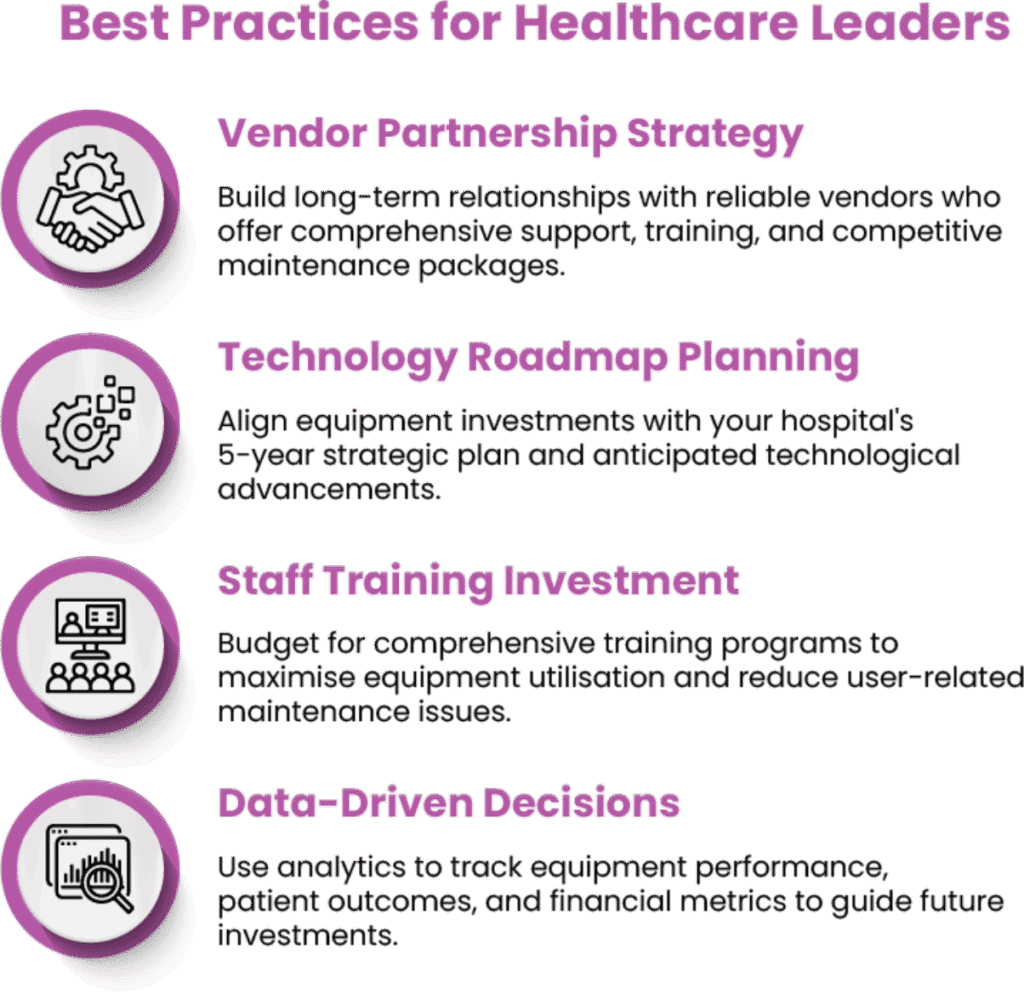

Forward-thinking hospital administrators have learned to approach equipment purchases differently. Instead of focusing solely on the acquisition price, they calculate the Total Cost of Ownership (TCO). This comprehensive approach considers not just the initial investment but also the ongoing operational expenses over the equipment’s expected lifespan.

TCO analysis includes maintenance costs, training expenses, utility consumption, insurance, and eventual disposal or replacement costs. This holistic view provides a more accurate picture of the true financial commitment involved in any capital purchase.

Strategic Budgeting Approaches

Successful hospitals implement several key strategies to manage the CapEx-OpEx balance effectively. They map Annual Maintenance Contract (AMC) and Comprehensive Maintenance Contract (CMC) costs for three to five years in advance, creating a clear picture of future financial obligations.

Regular quarterly reviews of Return on Investment (ROI) versus equipment uptime and actual usage patterns help identify underutilized assets and opportunities for optimization. This data-driven approach ensures that capital investments continue to deliver value throughout their operational life.

Integrated Financial Planning

Perhaps most importantly, smart hospital leaders budget operational expenses alongside capital expenditures from the very beginning. They recognise that these two categories are inseparably linked and must be planned together to achieve optimal financial outcomes.

This integrated approach extends to linking capital purchases directly to actual service utilisation. Before approving any significant equipment purchase, administrators analyse current demand patterns, projected growth, and the realistic capacity requirements of their facility.

Must Read- Hospital Management Software Questions to Know – Ezovion

The Path Forward

Changing the Conversation

The healthcare industry needs to shift its conversation from acquisition costs to lifecycle costs. This change requires leadership commitment, staff education, and systematic processes that ensure operational expenses are always considered alongside capital investments.

Building Sustainable Operations

Healthcare facilities that master this balance position themselves for long-term success. They avoid the common trap of exciting purchases followed by budget crises when maintenance bills arrive. Instead, they build sustainable operations that can consistently deliver quality patient care while maintaining financial stability.

The fundamental principle that guides these successful institutions is simple yet profound: what you buy isn’t what you spend—what you keep running is. This understanding transforms how healthcare leaders approach equipment purchases, ensuring that every capital investment contributes to the institution’s mission rather than becoming an unexpected burden.

By embracing comprehensive financial planning that integrates both capital and operational expenses, hospitals can make smarter decisions that benefit patients, staff, and the institution’s long-term viability.