Your patients who have insurance policy always needs assistance when it comes to claiming their insurance money. To fill the gaps here comes the role of “TPA medical insurance” In simple words, it deals with the complex process between the healthcare provider and policyholder to settle the health insurance claim as compensation.

What is TPA in Health Insurance?

TPA stands for Third Party Administrator in the context of health insurance. A Third-Party Administrator is a company that processes insurance claims and provides various administrative services for insurance companies. In health insurance, TPAs play a crucial role in managing policyholder services such as claim processing, premium collection, and customer service on behalf of the insurance provider. They act as intermediaries between the insurance company and the insured individuals, facilitating a smoother and more efficient administration of health insurance policies.

TPAs can be companies, organizations, or agencies that handle claims for both individual and corporate health insurance policies. They efficiently work for the insured parties and the insurance company, facilitating insurance claim processing. Despite their role in administration, the ultimate responsibility for bearing the risk of loss lies with the insurance company.

Overview of TPA medical insurance Status and Statistics:

Health insurance coverage in India falls short of the desired levels. As per the findings of the National Family Health Survey India report, just 41% of households have at least one regular member covered by health insurance. Additionally, between 2019 and 2021, health insurance or financing schemes extended coverage to only 30% of women aged 15-49 and 33% of men aged 15-49, highlighting the need for increased accessibility to healthcare protection.

Health Insurance Coverage Statistics

According to a recently published article in Forbes Advisor India, the Health insurance market is growing in India but due to the uneven distribution of the market majority of the population prefers private health insurance companies let’s look into the statistics.

- In 2021, health insurance schemes provided coverage for about 514 million people in India, representing only 37% of the nation’s population.

- Public health insurance or voluntary private health insurance covers an estimated 70% of the population, leaving the remaining 30%, equivalent to over 40 crore individuals, without health insurance.

- A significant proportion, approximately 400 million individuals, lacks access to health insurance.

Role of TPA Medical Insurance Benefits for both parties:

Third-Party Administrators (TPA) operating in the health insurance sector are regulated and approved by the Insurance Regulatory and Development Authority of India (IRDAI). The IRDAI sets guidelines and standards to ensure the proper functioning, compliance, and reliability of TPAs. The guidelines represents various aspects of health insurance, including claim processing and customer service. This regulatory oversight aims to protect the interests of policyholders and maintain a fair and transparent insurance ecosystem for both parties.

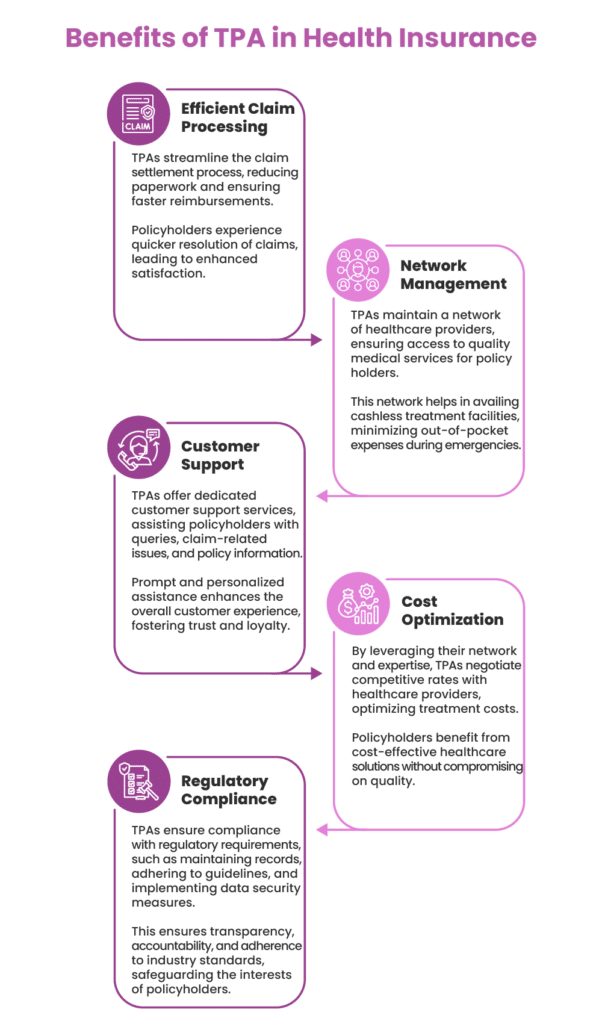

Advantages of TPA medical insurance for Policyholders:

– Streamlined claim processing

– Faster approvals for medical expenses

– Enhanced customer service

– Utilize a network of healthcare providers.

– Wider choices and potential discounts on services

– Assistance in understanding coverage and managing paperwork

Advantages of TPA in health insurance for Healthcare Providers:

– Reduced administrative burden in billing and claims processing

– Efficient handling of documentation, verification, and reimbursement processes

– Increased focus on patient care

– Assistance in maintaining standardized and transparent transactions

– Facilitation of smoother collaborations with insurance companies

– Improved efficiency in financial transactions

TPA Integration with Ezovion HIMS

Ezovion HIMS Solutions is a well-known and certified hospital management software (HIMS) provider which has a specialized TPA medical insurance integration system. Ezovion offers balancing, specifically visit and discharge balancing, with unmatched ease and precision in different modules. Apart from billing and accounting software, our HIMS includes Electronic Medical Records (EMR)/Electronic Health Records (EHR) with overall hospital and clinic management solutions for different healthcare providing scales. We have real-time data access that ensures healthcare institutions navigate specifically Third-Party Administrator (TPA in Health Insurance) landscape with seamless efficiency.

Some of the features of our integrated TPA system are stated below-

Claims Intimation:

Our system ensures quick and organized claims intimation, fostering seamless communication between the hospital and TPA in medical insurance.

Planned Claim:

We excel in managing planned claims, ensuring all necessary information is documented and readily accessible for processing.

Enrolment and Profile Management:

Efficiently handle patient information with precision, simplifying the enrollment process and maintaining comprehensive profiles for error-free claim processing.

Claims Audit & Investigation:

Count on us for effective data management, facilitating thorough claims audits and investigations. This helps hospitals maintain compliance and identify any irregularities in the claims process.

Document Management System:

Our HIMS guarantees a structured and secure document management system. It also facilitating the storage and retrieval of essential documents related to TPA interactions and claims.

Claim Adjudication:

Our TPA system streamlines the claim adjudication process, minimizing errors and expediting the assessment of claims for faster resolutions.

Tracking Tool for TPA in Health Insurance:

Incorporating a tracking tool, our HIMS monitors the status of claims, ensuring each stage of the process is efficiently managed and reported.

Finance Management:

Our system aids in account reconciliation by meticulously tracking billing, payments, and other financial transactions, promoting accuracy and transparency.

Payer Management:

Our TPA system assists hospitals in managing payers, ensuring seamless collaboration and communication.

Reporting & Dashboard:

Ezovion HIMS offers robust reporting and dashboard features, providing hospitals with valuable insights into their TPA interactions, claims status, and financial metrics.

SMS Integration:

Integrated SMS functionalities in HIMS enable effective communication between the hospital and TPA, keeping stakeholders informed about critical updates and claim statuses.

Conclusion:

In conclusion, integrating Third Party Administrator (TPA in health insurance) within a Hospital Information Management System (HIMS) is crucial for hospitals and policyholders. This synergy streamlines administrative processes, enhances patient care, and simplifies insurance navigation, making healthcare more efficient and patient centric. Whereas the combination of TPA services and HIMS is a pivotal factor in shaping the future of healthcare administration that navigates the complexities of the insurance landscape effortlessly and ultimately contributes to a more efficient and patient-centric healthcare ecosystem.

Source-